⏳ Only 3 Days Left! Black Friday Deals On Trading Courses 📈💰 Click Now for Exclusive Discounts!

🔥 Ready to stay steps ahead in the market? Our FREE VIP Newsletter is your golden ticket! 🌟 Limited spots available—grab yours now for exclusive insights and strategies:

Join our trading community for expert strategies and real-time market insights! Click now to follow us and level up your trading game. 📈🚀 :

💰 Unlock Pro Trading Secrets: Master Daytrading/Scalping with Our Advanced Course

Take your trading to new heights with our Day Trading Masterclass! Enroll now and save 25% with code SCALPINGYOUTUBE. Offer ends 11/30/2023. ⬇️

💡 Stay Ahead of the Market: Follow @fxevolution on Twitter for Live Updates

Never miss a beat with the latest market insights and news. Follow us on Twitter @fxevolution for live updates: 🔜

🔥 Outperform the Competition: Discover the Best Trading Opportunities with Our #1 TA Program & Data Service

Get the edge you need to succeed in the market. Try our #1 TA program:

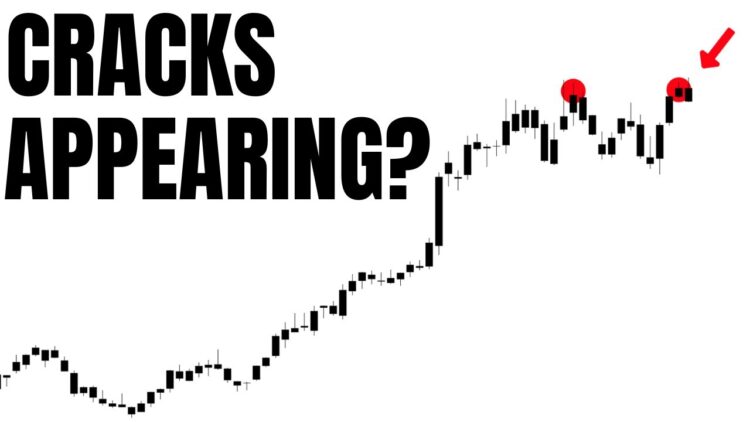

In this video, we dive into the latest hot topic in finance: the US CPI numbers and their impact on the stock market, cryptocurrencies, and commodities. We’ll discuss what the numbers mean for investors and traders and how you can stay ahead of the curve in these turbulent times. Join our community of finance enthusiasts for more insights and analysis on the market trends that matter.

DISCLAIMER: The information contained in this video is generic in nature and for educational purposes only. The information does not take into account your personal objectives, financial situation or needs. This information is not to be construed as an offer, recommendation or solicitation to buy, sell or to participate in any particular trading strategy or investment advice. FX Evolution does not represent that any of the information provided is accurate, current, or complete and you should not rely upon it when making your trading or investment decisions.

CFDs and margin FX are leveraged products that carry a high level of risk to your capital. You do not own, or have any rights to, the underlying assets. Trading is not suitable for everyone and may result in you losing substantially more than your initial investment. Past performance is no indicator of future performance. Please consider the risks involved, seek independent advice and read the relevant legal documentation (available on our website) before making a trading or investment decision.

DISCLOSURE: We only recommend products and services that we use on a daily basis. Some of the links on this webpage are affiliate links, meaning, at no additional cost to you, we may earn a commission if you click through and make a purchase and/or subscribe. Commissions earned will be used towards growing this channel as we wish to spread our knowledge and years of experience

#Stockmarket

#DayTrading

#StockMarketAnalysis

Amazing video, A friend of mine referred me to a financial adviser sometime ago and we got talking about investment and money. I started investing with $120k and in the first 2 months , my portfolio was reading $274,800. Crazy right!, I decided to reinvest my profit and gets more interesting. For over a year we have been working together making consistent profit just bought my second home 2 weeks ago and care for my family.

Started this video thinking I would skip through a lot but watched from beginning to end. very thorough!

Stocks extended their year-to-date rally following the CPI report, with the S&P 500 last up 0.8% in afternoon trading. but I don't know if stocks will quickly rebound, continue to pull back or move sideways for a few weeks, or if conditions will rapidly deteriorate.I am under pressure to grow my reserve of $250k.

Weakness?…. there's never weakness. Elevator up always

When it comes to making smart investments, keeping an eye on the yield curve can be helpful. If the yield curve starts to invert, it may be a good idea to consider adjusting your investment strategy. it's just one piece of the puzzle, but it can provide insight into the overall economic climate. I have poured about $80k into the market holding good positions.

I'd be interested to see the performance by dividend income for all of these players vs the S&P 500 too. Can it safeguard and grow $500k cash reserve for next 2 years at no risk?

Should be an interesting 2024. Thanks for all your information.

I was advised to diversify my portfolio among several assets such as stocks and bonds since this can protect my portfolio for retirement. I'm seeking to invest $200K across markets but don't know where to start.

Commercial mortgage backed securities is what is broken IMO banks and hedge funds are swapping the "risk's" around right now just don't know when the music will stop.

tom this video good for 2 thing only….more dollars for me!

Thanks

Idea on what broke. Banking reserve requirements. Regionals unloved?

I've been quite unsure about investing in this current market and at the same time I feel it's the best time to get started on the market. i was at a seminar and the host spoke about making over $972,000 within 3 Months with a capital of $200,000. I just need creative ideas to afford my retirement.

Big ups and big love for the awesome daily content. Because inflation devalues your savings, it compels everyone to be an investor. Meaning you need to preoccupy yourself or offload your time/energy to the study of investment opportunities both of which are very costly. Thanks to Thomas Easton for showing me the appropriate way to get into bitcoin investing and trading with his trade signal and investing guidelines. Investing and trading are more than just having TA skills. There is a big component of discipline and emotional maturity, that one has to work on! Time in the market vs. timing the market. If you keep that mentality as an investor, you will stay calm during the storm! Within some months I was making a lot more money and have continued on that same path with Thomas Easton.

What’s broken? Could it be that the increase in interest rates has made T bills significantly more attractive than either bank deposits or money management accounts (by several %). If all the deposit funds flow out of banks and money management funds it’s like a run on the banks – suddenly banks have no funds to lend and are at risk, and regional banks are particularly vulnerable. Rather than face large numbers of failing banks the Fed has again gone for QE, lending to banks again?

What is broken? The US Deficit… At 30+ trillion, the Central bank HAS to be a buyer of bonds, and they cannot afford to keep interest rates at this level for much longer. Plain as daylight.

Looks like the Eurodollar CB director's may be a bus load of Arthur Burns followers.

Tom please tell where you get data on central bank liquidity injections.

That's also an engulfing green candle on the weekly ethereum chart!

how does yellen sell trillions in bonds if rates are lowered?

We forget just how much dough was injected into the money supply during their pandemonic. It will take at least a decade more, if not TWO or THREE to see that money come into the dummy economy. They are going to have to keep interest rates high to counter that kind of inflation. In Canada they injected more debt in 2 years than the first 115 years of existence of the State. That's a hell of a lot of new debt out there. So yes, there will be no rate cut.

Thanks for everything! Great information as always.

As we approach Thanksgiving, investors have a lot to be grateful for, given recent market moves. The rest of the year and the beginning of 2024 should be merry and bright as well. Despite the S&P 500 doing well. I have lost a large share of my $640k portfolio in the last 4 months . How do I turn this around?

I swear he said it's dangerous for both bulls and bears on SPY right now

No cracks are appearing. This is absurd!

Certain equities typically climb around this time of year, but given the current recession and economic environment, that is doubtful. I'm holding a lot of stocks in the hopes of making money this month, but I'm not sure whether to keep them or sell them. I've been losing money since Q2 2022, and the picture for investors in 2023 doesn't appear great.

Thank you

I love those central bank liquidity indicator (around 16:02) – would you be willing to share which indicators your using in Trading view for that? Would love to run it on my chart.

Great content as always!

What is inflation

Inflation is all the talking monkeys you put in charge trying to cover up the fact that the books have been corrupted and manipulated and cooked for hundreds of years

There arent going to be any rate cuts. The media and wall st are feeding you the biggest fairy tale yet and youre lapping it up. Theyre all disciples of the era of ZIRP and they think that once inflation comes down to the feds target, rate cuts begin. Why do rates get cut? NO EXPLANATION IS GIVEN. This economy (and stock market) is a result of 15 years of artificially suppressed interest rates. It was an experiment that enriched the few and is now destroying the rest. That era is over.

AI sector still leading the charge UP in Nov, but small cap AI now leading. * SOUN.. 38 % gains month. SoundHound. 52 % revenue increase 3rd qt over 2nd qt, 219 institutional growing investors..Palantir up 25 % mth…Big Bear Ai up 46 % mth..T Stamp up 24 % mth…Nvidia up 18 % mth..Bullfrog Ai Up 7 % mth. Let's see the New Bull market keep charging in 2023.

People's credit card debt is spiking and those same people have student loan debt they have to start paying on. That combined with inflation the younger generation is screwed.

Laughable

The most significant lesson I gained from the stock market in 2023 is that uncertainty prevails, emphasizing the importance of humility. Adhering to a long-term strategy with a competitive edge is key

You've costed me so much money lol bs negativity

Must say, the markets looks good right now. Probably going back to all time highs, but will probably go sideways until fed signals rate cut, Recently sold 25% of my $620k portfolio comprising of plummeting stocks that were recommended by certain financial YouTubers, quite devastating!

I appreciate the effort you dedicated to creating this video.

What is the index called that tracks central banks liquidity injections?

Like your Gldn

imo the Fed will absolutely Not cut in December. don't care what the stats say. people in the US are freaking out about inflation. literally everyone in the USA is talking it

Tom I’m confused by your comment about the Russell being dull. I made a killing on Friday. It broke the triangle it’s been sitting in since 14 November and looks poised for more upside. Am I not seeing something?

Recession is coming fast

my washing machine is broken

Sometime is easy for us to get lost by all of these ups and downs in the stock market. If you are wondering why central banks started to inject money back in to the economy, just look around you. I work in an industry that we generally doing ok salary wise but people struggling badly at the moment. They don’t have money most of the month and there is no money left to spend. My partner works for a big supermarket and she was saying how much they see a decline in people’s buying power. Warehouses are full of stuff and people have no money to spend.

Does selling otm calls count as bullish?